Contents:

“The Fed really pumped up the money supply remarkably, especially in the early months of the pandemic – it wanted to avoid any kind of financial crisis. It succeeded in doing that, but it pushed out a lot of inflation.” Soaring inflation in the US isn’t likely to ease off any time soon — and that means the Federal Reserve will have to stick with its vigorous plan to keep raising interest rates, according to high-profile economist Jeremy Sachs. The many factors driving high US prices mean it will have to keep hiking interest rates, he told CNBC. Inflation will likely remain high – so investors need to brace for aggressive Fed rate hikes, according to Columbia University economist Jeffrey Sachs. If a user or application submits more than 10 requests per second, further requests from the IP address may be limited for a brief period. Once the rate of requests has dropped below the threshold for 10 minutes, the user may resume accessing content on SEC.gov.

Is Vertiv Holdings Co (VRT) a Stock to Watch After Gaining 5.14% This Week? – InvestorsObserver

Is Vertiv Holdings Co (VRT) a Stock to Watch After Gaining 5.14% This Week?.

Posted: Thu, 30 Mar 2023 07:00:00 GMT [source]

This SEC practice is designed to limit excessive automated searches on SEC.gov and is not intended or expected to impact individuals browsing the SEC.gov website. To allow for equitable access to all users, SEC reserves the right to limit requests originating from undeclared automated tools. Your request has been identified as part of a network of automated tools outside of the acceptable policy and will be managed until action is taken to declare your traffic. This availability information regarding shortable stocks is indicative only and is subject to change. IB does not accept short sale orders for US stocks that are not eligible for DTC continuous net settlement and all short sale orders are subject to approval by IB.

Tata Group Stock Sheds 6% Despite Q4 Profit Rallying 116%: Here’s Why

Investing.com – U.S. equities were higher at the close on Thursday, as gains in the Industrials, Telecoms and Technology sectors propelled shares higher. Investing.com – U.S. equities were higher at the close on Friday, as gains in the Industrials, Telecoms and Technology sectors propelled shares higher. Investing.com – U.S. equities were higher at the close on Tuesday, as gains in the Healthcare, Telecoms and Technology sectors propelled shares higher. Other issues outside the central bank’s control are likely to further fuel rises in prices, he believes. To ensure our website performs well for all users, the SEC monitors the frequency of requests for SEC.gov content to ensure automated searches do not impact the ability of others to access SEC.gov content. We reserve the right to block IP addresses that submit excessive requests.

Current guidelines limit users to a total of no more than 10 requests per second, regardless of the number of machines used to submit requests. For best practices on efficiently downloading information from SEC.gov, including the latest EDGAR filings, visit sec.gov/developer. You can also sign up for email updates on the SEC open data program, including best practices that make it more efficient to download data, and SEC.gov enhancements that may impact scripted downloading processes. Complete Phase I of multi-year development program with top 10 global automaker in Q2 2023. Net loss in the full year 2022 was $7.2 million compared to $4.8 million in the full year 2021.

We disclaim any intention to, and undertake no obligation to, update or revise forward-looking statements. For more information read the Characteristics and Risks of Standardized Options, also known as the options disclosure document . Alternatively, please contact IB Customer Service to receive a copy of the ODD. Before trading, clients must read the relevant risk disclosure statements on our Warnings and Disclosures page. Trading on margin is only for experienced investors with high risk tolerance. For additional information about rates on margin loans, please see Margin Loan Rates.

Two universities evaluating B-TRAN™ for electric vehicle charging applications. Operating expenses in the full year 2022 were $7.3 million compared to $4.8 million in the full year 2021 with higher research and development spending accounting for a majority of the increase. Grant revenue was $203,269 for the full year 2022 compared to $576,399 for the full year 2021. Investing.com – U.S. equities were higher at the close on Monday, as gains in the Oil & Gas, Healthcare and Financials sectors propelled shares higher. Investing.com – U.S. equities were higher at the close on Friday, as gains in the Telecoms, Oil & Gas and Financials sectors propelled shares higher.

TECH

what is basic salary difference between gross pay.com – U.S. equities were mixed at the close on Monday, as gains in the Oil & Gas, Technology and Telecoms sectors propelled shares higher while losses in the Basic Materials,… Investing.com – U.S. equities were lower at the close on Friday, as losses in the Healthcare, Consumer Goods and Basic Materials sectors propelled shares lower. Ideal Power Inc share price live 9.98, this page displays NASDAQ IPWR stock exchange data. View the IPWR premarket stock price ahead of the market session or assess the after hours quote. Monitor the latest movements within the Ideal Power Inc real time stock price chart below.

Operating expenses in the fourth quarter of 2022 were $2.0 million compared to $1.4 million in the fourth quarter of 2021 driven primarily by higher research and development spending. Grant revenue was $16,608 in the fourth quarter of 2022 compared to $128,605 in the fourth quarter of 2021. The risk of loss in online trading of stocks, options, futures, currencies, foreign equities, and fixed Income can be substantial.

About Ideal Power Inc

Grant revenue was $50,978 in the second quarter of 2022 compared to $ 84,705 in the second quarter of 2021. Entered into a product development agreement with a top 10 global automaker for a custom B-TRAN™ power module for use in EV drivetrain inverters in the automaker’s next generation EV platform. Represents Ideal Power’s second engagement with a leading global automobile manufacturer. The Columbia University economics professor warned investors to brace for further tightening from the US central bank, as he believes supply-chain hold-ups and geopolitical shocks will continue to push prices up. Net loss in the second quarter of 2022 was $1.7 million compared to $1.2 million in the second quarter of 2021. Operating expenses in the second quarter of 2022 were $1.7 million compared to $1.3 million in the second quarter of 2021.

Ideal Power, Inc. engages in the development of power converter solutions for photovoltaic generation, grid-storage and electrified vehicle charging. Its products include solar inverters, bi-directional battery, electric vehicle chargers, photovoltaic inverters and battery converters. The firm has developed the patented Power Packet Switching Architecture power conversion technology. The company was founded by William C. Alexander on May 17, 2007 and is headquartered in Austin, TX. According to regulations, Indian residents are eligible to trade all available products on domestic Indian markets, including futures and options. On non-Indian markets, Indian residents are prohibited from trading futures, options or margin-based products but are permitted to trade stocks, bonds and ETFs.

https://1investing.in/.com – Ideal Power Inc reported on Monday third quarter erl-48406||earnings that beat analysts’ forecasts and revenue that fell short of expectations.

Settings

Ideal Power reported Q2 EPS of ($0.27), $0.02 better than the analyst estimate of ($0.29). Revenue for the quarter came in at $50.98 thousand versus the consensus estimate of $200… Ideal Power reported Q3 EPS of ($0.28), $0.01 better than the analyst estimate of ($0.29). Revenue for the quarter came in at $10 thousand versus the consensus estimate of $200… Ideal Power reported Q4 EPS of ($0.31), $0.02 better than the analyst estimate of ($0.33).

While Ideal Power’s management has based any forward-looking statements included in this release on its current expectations, the information on which such expectations were based may change. Such forward-looking statements include, but are not limited to, statements regarding our 2023 milestones and B-TRAN™ having the potential to displace conventional power semiconductor solutions in many applications. These forward-looking statements rely on a number of assumptions concerning future events and are subject to a number of risks, uncertainties and other factors, many of which are outside of our control that could cause actual results to materially differ from such statements. Furthermore, we operate in a highly competitive and rapidly changing environment where new and unanticipated risks may arise. Accordingly, investors should not place any reliance on forward-looking statements as a prediction of actual results. We disclaim any intention to, and undertake no obligation to, update or revise forward-looking statements, except as required by applicable law.

“We delivered initial packaged and tested B-TRAN™ devices to Diversified Technologies, Inc. , our Naval Sea Systems Command program collaboration partner, in preparation for a full-scale medium voltage direct current circuit breaker demonstration. We also added commercial and university participants to our test and evaluation program and released our new driver design for fabrication to support program participants. In addition, we completed the qualification of a world-class packaging firm for volume production. Our talented, energized team remains focused on execution of our commercialization strategy toward our objective of introducing our first commercial product by year end,” stated Dan Brdar, President and Chief Executive Officer of Ideal Power. The packaged devices were tested prior to shipment and demonstrated the very low conduction losses predicted by prior internal and third-party simulations.

Engaged a third-party firm to conduct long-term reliability testing of B-TRAN™ devices, involving tens of thousands of power cycles to assess the mechanical integrity of the design. Completed the qualification of a world-class packaging firm to transition to a new packaging concept for volume production. Ideal Power now has qualified both a domestic and a non-domestic packaging firm. Launched first commercial product, the SymCool™ Power Module in January 2023 with first commercial sales later in 2023. Cash and cash equivalents totaled $16.3 million at December 31, 2022. To prepare for commercial product shipments, the Company is nearing completion of a full process flow engineering run at a wafer fabrication partner with high-volume production capability.

DTI will incorporate packaged B-TRAN™s into a full-scale MVDC circuit breaker. Ideal Power is on track to complete its deliveries of additional B-TRAN™ devices later this year and will continue to provide program support through the demonstration of the B-TRAN™ enabled direct current solid-state circuit breaker . Cash used in operating and investing activities in first quarter 2022 was $1.7 million compared to $1.4 million in the first quarter of 2022 and $1.1 million in second quarter 2021.

Pineapple Energy Stock (NASDAQ:PEGY), Quotes and News … – Benzinga

Pineapple Energy Stock (NASDAQ:PEGY), Quotes and News ….

Posted: Fri, 01 Apr 2022 17:08:08 GMT [source]

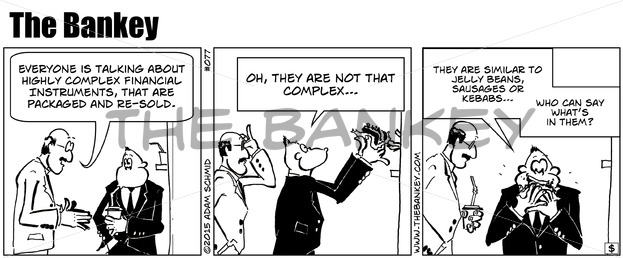

Security futures involve a high degree of risk and are not suitable for all investors. Before trading security futures, read the Security Futures Risk Disclosure Statement. Structured products and fixed income products such as bonds are complex products that are more risky and are not suitable for all investors. Before trading, please read the Risk Warning and Disclosure Statement.

CASH

Revenue for the quarter came in at $10 thousand versus the consensus estimate of $0 . These values are calculated using the oldest historical opening price available and taking into account all splits and dividends history. Therefore, the results presented here are not 100% accurate and just a close estimation.

CE+T Energy Solutions Acquires Ideal Power’s Power – GlobeNewswire

CE+T Energy Solutions Acquires Ideal Power’s Power.

Posted: Tue, 24 Sep 2019 07:00:00 GMT [source]

The test results in the new whitepaper match the Company’s previous simulation data, further validating the B-TRAN™ technology. This whitepaper includes recent test results using the Company’s newly designed driver and double-sided cooled packaged devices. It shows switching characteristics and waveforms important for customer technical teams using double pulse testing, including testing in bidirectional mode. Shipped additional B-TRAN™ devices to Diversified Technologies, Inc., our Naval Sea Systems Command program collaboration partner, in preparation for a full-scale medium voltage direct current circuit breaker demonstration. Launched its first commercial product, the SymCool™ Power Module, a multi-die B-TRAN™ module designed specifically to enable solid-state circuit breakers to deliver very low conduction losses. Investing.com – U.S. equities were lower at the close on Wednesday, as losses in the Healthcare, Telecoms and Basic Materials sectors propelled shares lower.

You can find more details by visiting the additional pages to view historical data, charts, latest news, analysis or visit the forum to view opinions on the IPWR quote. Start adding relevant business details such as description, images and products or services to gain your customers attention by using Boost 360 android app / iOS App / web portal. By using this site, you are agreeing to security monitoring and auditing.

- Soaring inflation in the US isn’t likely to ease off any time soon — and that means the Federal Reserve will have to stick with its vigorous plan to keep raising interest rates, according to high-profile economist Jeremy Sachs.

- Revenue for the quarter came in at $10 thousand versus the consensus estimate of $200…

- Before trading security futures, read the Security Futures Risk Disclosure Statement.

- Entered into a product development agreement with a top 10 global automaker for a custom B-TRAN™ power module for use in EV drivetrain inverters in the automaker’s next generation EV platform.

- Grant revenue was $203,269 for the full year 2022 compared to $576,399 for the full year 2021.

- Alternatively, please contact IB Customer Service to receive a copy of the ODD.

Cash used in operating activities in full year 2022 was $6.4 million compared to $4.3 million in full year 2021. Net loss in the fourth quarter of 2022 was $1.9 million compared to $1.4 million in the fourth quarter of 2021. Released a new Ideal Power whitepaper entitled B-TRAN™ – Device Structure, Performance and Applications.